Context – The Hindu Newspaper – “Rising state borrowings complicate Indian central bank’s rate playbook” 20 January 2026. It is important to understand the concepts behind this news like State Development Loans (SDLs), Bond Yields(Return), government securities etc. which are important for UPSC Prelims exam and UPSC frequently asks questions on these concepts.

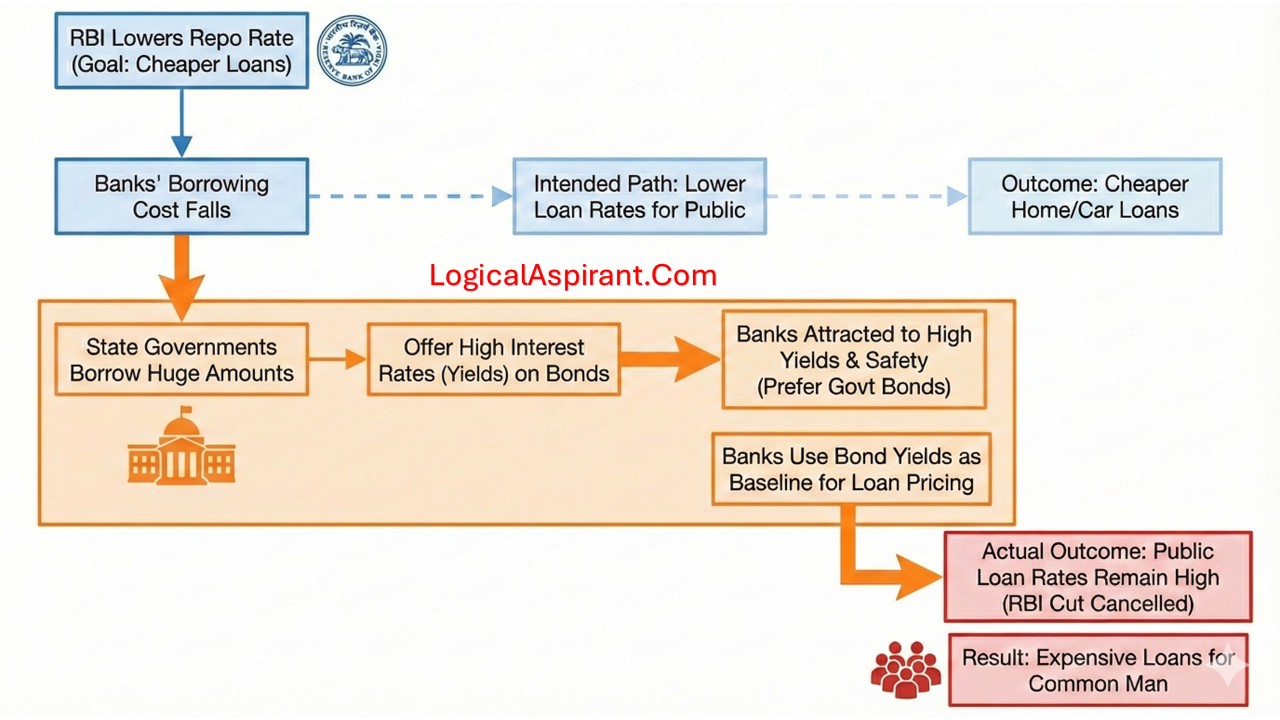

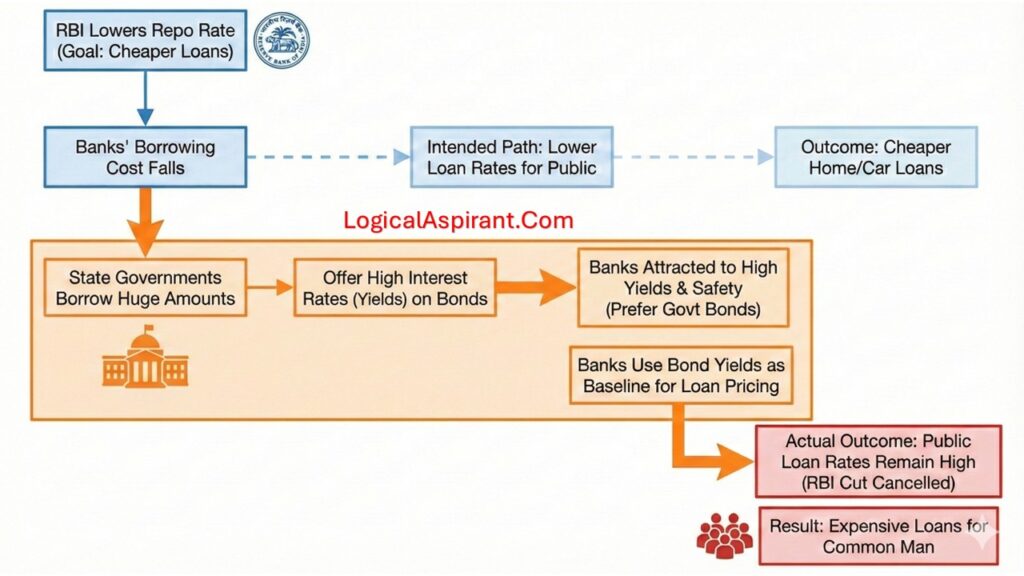

Imagine the RBI tries to make loans cheaper for people by lowering the cost at which banks borrow money (Repo Rate). Ideally, banks should pass this benefit to you by lowering interest rates on home or car loans. However, State Governments are simultaneously borrowing huge amounts of money, offer high interest rates (yields) on their bonds to attract lenders (Banks). Banks, looking for profit and safety, prefer to lend to the government at these high rates rather than lowering rates for the public. Since banks use these government bond rates as a baseline to decide their own loan prices, the high bond yields effectively cancel out the RBI’s rate cut, leaving the common man with expensive loans despite the RBI’s best efforts.

Surge in market borrowings by Indian State governments (through State bonds) is complicating the RBI efforts to lower interest rates. Official name for State bonds are State Development Loans (SDLs). Lets learn more about these terms.

What are State Development Loans (SDLs)?

SDLs are dated securities issued by State Governments to raise loans from the market. The Reserve Bank of India (RBI) manages these borrowings on behalf of the States.

- They are similar to Central Government Securities (G-Secs) but are issued by States.¹

- SDLs are eligible securities for maintaining the Statutory Liquidity Ratio (SLR) by banks. They are also eligible as collateral for borrowing funds from the RBI under the Liquidity Adjustment Facility (LAF).¹

Statutory Liquidity Ratio (SLR) – mandatory percentage of a bank’s total deposits that it must maintain in the form of specific liquid assets. Banks are allowed to buy SDLs and count them toward this mandatory reserve

Sometimes, banks face a temporary shortage of cash and need to borrow money quickly from the Reserve Bank of India (RBI). This borrowing window is called the Liquidity Adjustment Facility (LAF). RBI accepts SDLs as that guarantee to these borrowings.

To understand why State borrowing affects interest rates, you must understand the relationship between Bond Supply, Price, and Yield.

Bond prices and bond yields(Return) move in opposite directions. When demand for bonds is high, prices rise, and yields fall. Conversely, when supply is high (too many bonds in the market), prices fall, and yields rise.² Understand this with the example given below.

| Scenario | Bond Price You Pay | Interest You Get | Yield (Return) |

| Normal | ₹100 | ₹5 | 5% (Exactly the coupon) |

| Discount | ₹90 (Cheaper) | ₹5 | 5.5% (Higher return!) |

| Premium | ₹110 (Expensive) | ₹5 | 4.5% (Lower return) |

When State governments flood the market with a large number of bonds (SDLs), they create an oversupply that forces them to offer better terms to attract investors. To ensure these bonds get sold, states essentially put them “on sale” at a discounted price, which results in the investor getting a higher effective interest rate (yield). Because investors view these state bonds as nearly as safe as Central Government bonds (G-Secs), this creates a competitive environment; if states are paying higher returns, investors naturally expect the Central Government to match those rates, dragging the interest rates for Central bonds upward as well.

SDLs are issued through auctions conducted by the RBI on its electronic platform (E-Kuber).¹

Types of Government Securities

- Treasury Bills (T-Bills): Short-term debt instruments (91, 182, 364 days). Issued only by the Central Government (States generally do not issue T-Bills).¹

- Cash Management Bills (CMBs): Short-term instruments to meet temporary cash flow mismatches (less than 91 days).¹

- Dated Securities: Long-term securities (5 to 40 years). Issued by both Centre (G-Secs) and States (SDLs).¹

Important points to note

SDLs are not explicitly guaranteed by the Central Government. However, market players treat them as “quasi-sovereign” because the RBI manages the issuance and repayment, often debiting State accounts automatically to pay investors. This creates an implicit trust, but legally, they are liabilities of the State, not the Centre.

Only the Central Government issues Treasury Bills. States usually rely on Ways and Means Advances (WMA) from the RBI for temporary cash mismatches, not T-Bills.¹ State government has to repay this money quickly (usually within 90 days) and pays an interest rate equal to the Repo Rate (the same rate at which banks borrow from the RBI)

Sources

1. Reserve Bank of India (RBI). FAQs on Government Securities Market.

2. Reserve Bank of India (RBI). Monetary Policy Report.

3. Reserve Bank of India (RBI). Report on Monetary Transmission.