What is Bond ?

Suppose Reliance needs ₹1,00,000 to expand its business. Instead of taking a bank loan, it decides to borrow this money from the public.

Reliance issues 100 documents, each worth ₹1,000, and tells the public that anyone who buys this document will get ₹1,000 back after 2 years. Along with that, Reliance will pay ₹100 every year as interest.

This ₹1,000 document is called a bond.The annual ₹100 paid by Reliance is the interest (also called coupon). Since ₹100 on ₹1,000 is 10%, people commonly refer to this return as yield, meaning return in simple words.

Now, a bond offering higher returns usually carries higher risk.

Reliance may offer a return of 10%, but a financially weaker company like GTL Infra may offer 20%. The reason is risk. There is a higher chance that GTL Infra may fail to pay interest on time or may even fail to return the ₹1,000 principal. In other words, it may default.

Risk associated with bond investment:

One major risk is credit risk.

Bonds rated from AAA to BBB are called investment-grade bonds. Bonds rated below BBB are low-grade or junk bonds. These bonds are riskier because the issuer may default on interest payments or, in extreme cases, may not return the principal amount

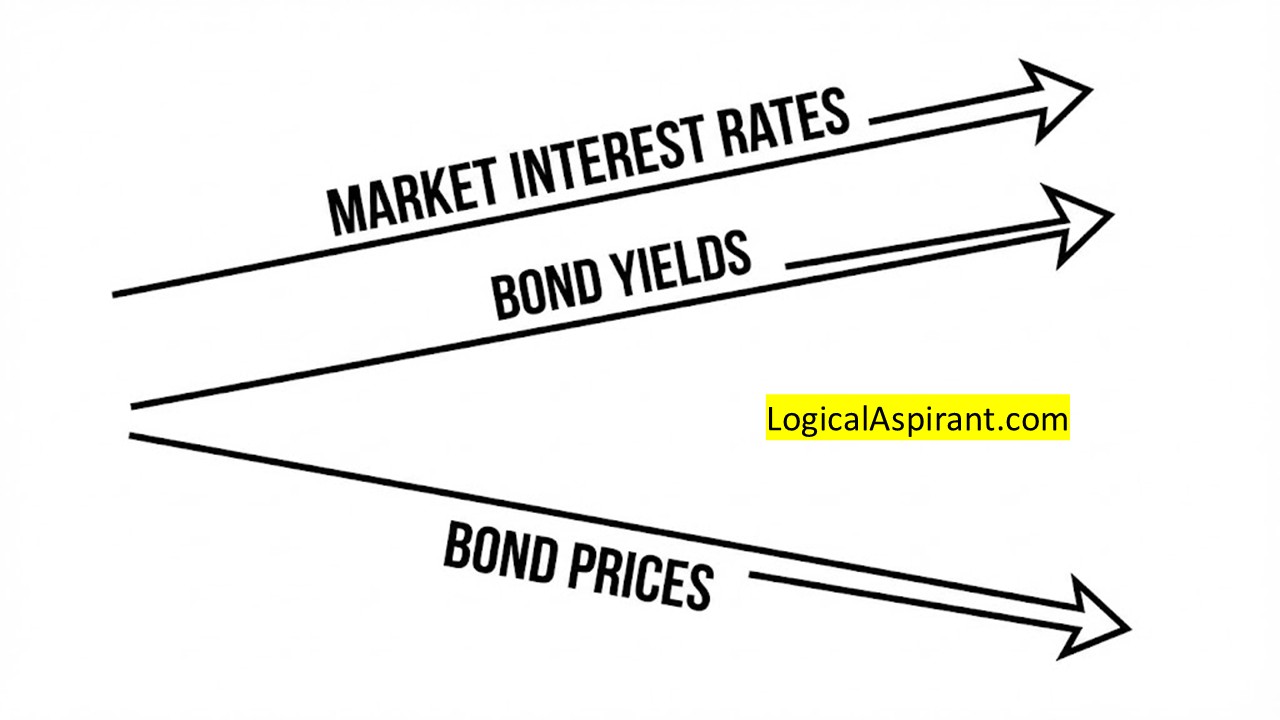

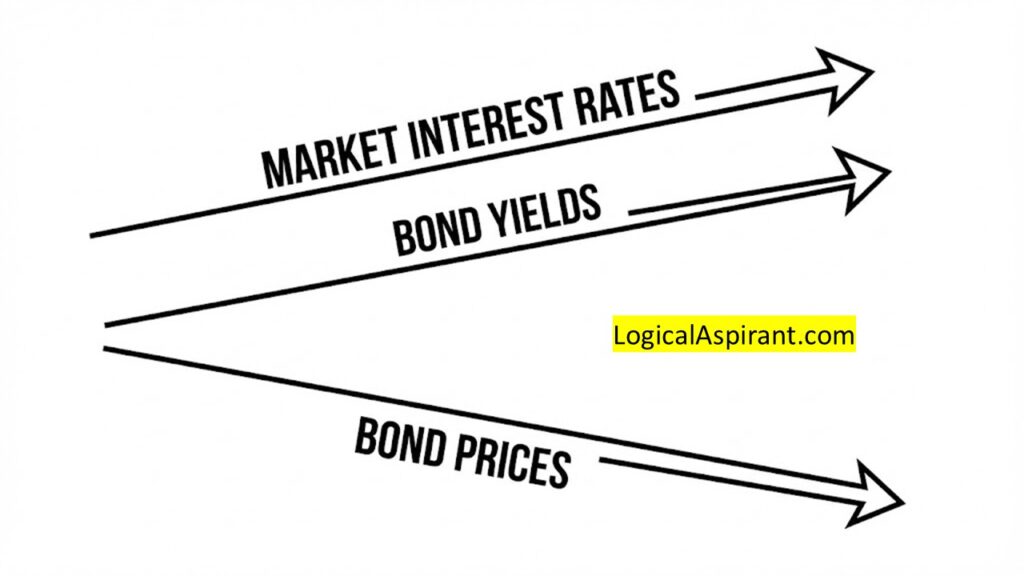

There is also an inverse relationship between bond price and yield, and this relationship is driven by changes in market interest rates.

Bond yield moves in line with market interest rates.

When market interest rates rise, newly issued bonds offer higher interest. Existing bonds with lower fixed interest become less attractive, so their market price falls. Because the same fixed interest is now available at a lower price, the yield on these bonds rises.

When market interest rates fall, newly issued bonds offer lower interest. Existing bonds with higher fixed interest become more attractive, so their market price rises. Because investors are paying a higher price for the same fixed interest, the yield on these bonds falls.