Context – Union Budget presentation approaches (February 1), the petroleum industry has raised demands for reviewing the Oil Industry Development (OID) Cess and incentivizing exploration. This article explains the static economic concepts behind oil taxation, the OID Board, and the structure of hydrocarbon sector.

The petroleum industry has urged the Union government to review the Oil Industry Development (OID) Cess, currently levied at 20% ad-valorem on production from nomination blocks (allocated directly by the GOI to Oil Companies without any competitive bidding.) As an aspirant you must go behind the news and understand the important concepts the covered in this news.

Upstream and Downstream Activities

- Upstream: This sector involves the exploration and production (E&P) of crude oil and natural gas. It is high-risk and capital-intensive (e.g., searching for oil in deep oceans). “Frontier Basins” or Mature basins belong here.¹

- Downstream: This involves the refining of crude oil into finished products (petrol, diesel, jet fuel) and their marketing/distribution to consumers. “Refinery capacity upgradation,” is a downstream activity.¹

Oil Industry Development (OID) Cess

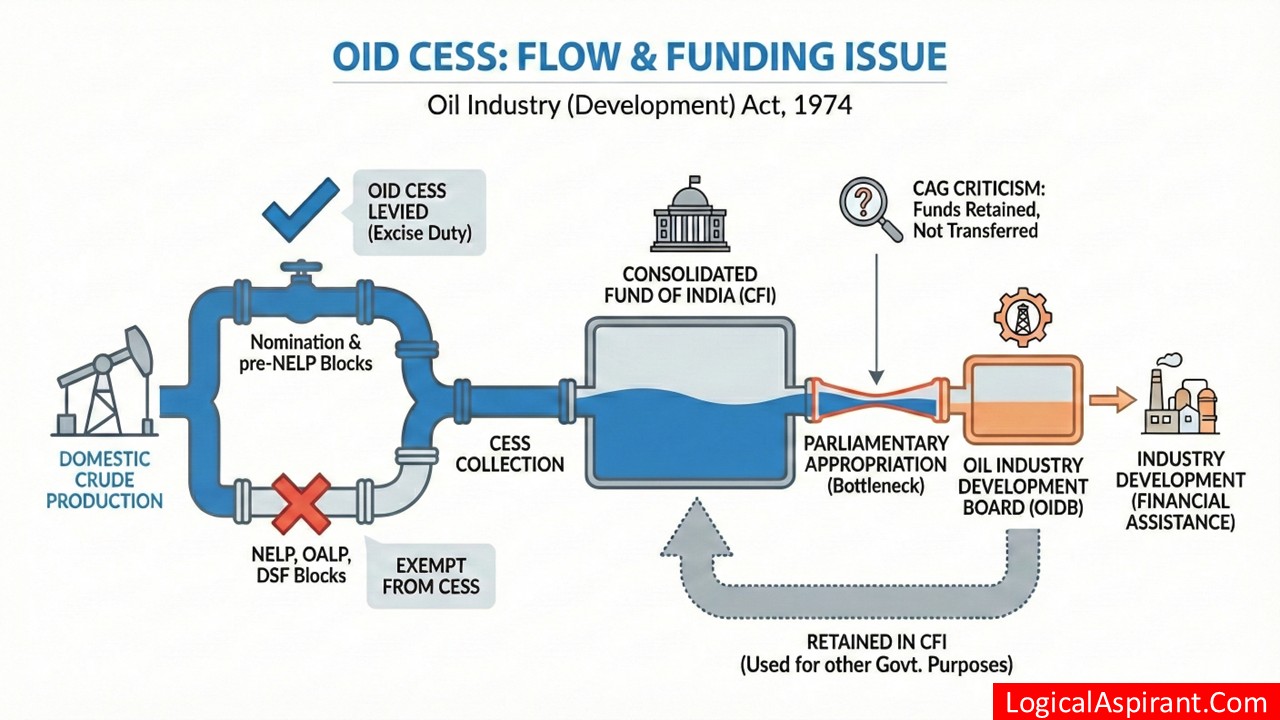

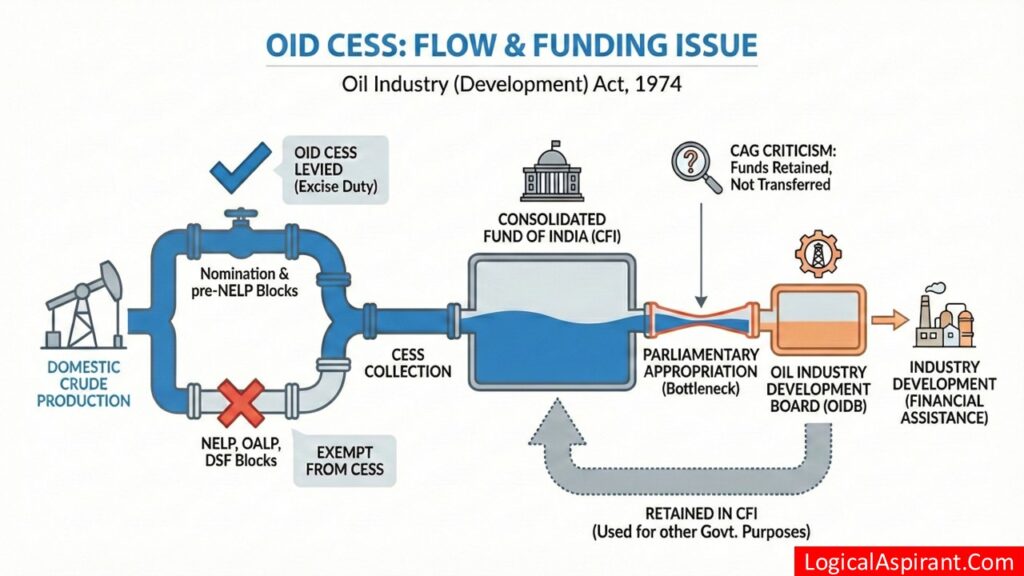

- Cess is levied under the Oil Industry (Development) Act, 1974. It is excise duty levied on crude oil produced domestically. The objective is to collect funds to develop the oil industry.

- OID cess only applies to crude oil produced from nomination and pre-NELP blocks. Production from blocks awarded through competitive bidding under exploration licensing policies such as NELP (New Exploration Licensing Policy), OALP (Open Acreage Licensing Policy) and DSF (Discovered Small Fields) is exempt from OID cess.

- These funds are supposed to be credited to the Oil Industry Development Board (OIDB) to provide financial assistance to the sector. ²

- The cess goes into the Consolidated Fund of India (CFI) first. The government then allocates money to the OIDB after due appropriation by Parliament. Criticism of this arrangement (often cited by CAG) is that a large portion of the collected cess is retained in the CFI and not transferred to the OIDB for industry development.

Ad-Valorem vs. Specific Duty

- Specific Duty: A fixed amount per tonne (e.g., ₹4,500 per tonne). This remains constant regardless of oil prices.

- Ad-Valorem: A percentage of the value (e.g., 20% of the crude oil price). The industry prefers a review (or slab system) because when global oil prices rise, the tax burden increases significantly under an ad-valorem regime.

Petroleum Taxation Structure

The petroleum sector operates under a unique taxation structure compared to other industries in India.

| Feature | Details | Status |

| GST Status | Five petroleum products (Crude Oil, Diesel, Petrol, Natural Gas, Aviation Turbine Fuel) are constitutionally included in GST but are currently zero-rated (effectively excluded). | Article 279A(5) of the Constitution: GST Council to decide the date of inclusion. ³ |

| Current Tax Regime | These 5 products attract Central Excise Duty (Centre) + VAT/Sales Tax (States). | This leads to the “Cascading Effect” (Tax on Tax) as companies cannot claim Input Tax Credit (ITC). |

Nomination Blocks – These are oil blocks granted to National Oil Companies (like ONGC, OIL) by the government without competitive bidding (mostly pre-NELP era). The OID Cess is primarily applicable here.⁴

Frontier Basins– Geological basins which are new and where exploration has been minimal or non-existent, carrying higher risk but high potential.⁴

Mature fields – still have oil but production has peaked and is declining. They require Enhanced Oil Recovery techniques (injecting gas/chemicals) to extract the remaining oil, which is costly. Frontier fields are new, unexplored areas.

Things you must understand and know for conceptual clarity

- GST “Exemption” vs. “Deferment”

- Alcohol for human consumption is the only item permanently excluded from GST by the Constitution. Petroleum products are inside the constitutional definition of GST, but the levy is deferred until the GST Council recommends a date (Article 279A). ³

- Cess vs. Tax

- A Cess is a tax levied for a specific purpose (e.g., OID Cess, Health & Education Cess). Proceeds from cesses are not part of the Divisible Pool of taxes; they are retained entirely by the Centre unless a specific law says otherwise.

Sources

1. Ministry of Petroleum & Natural Gas (MoPNG), Basic Statistics on Indian Petroleum & Natural Gas, Govt. of India Website

2. Oil Industry Development Board (OIDB), About OIDB & The OID Act, 1974, OIDB Official Website.

3. Ministry of Law and Justice, The Constitution (One Hundred and First Amendment) Act, 2016, Official Gazette.

4. Directorate General of Hydrocarbons (DGH), Hydrocarbon Exploration and Licensing Policy (HELP), DGH Website.