Trade agreements with various countires like UK, Oman, EU, USA etc have remained in news in 2025. India and the United States engaged in multiple rounds of talks for a Free Trade Agreement (FTA). However, negotiations for an India–US trade deal continue to be complex and largely stalled due to unresolved differences.

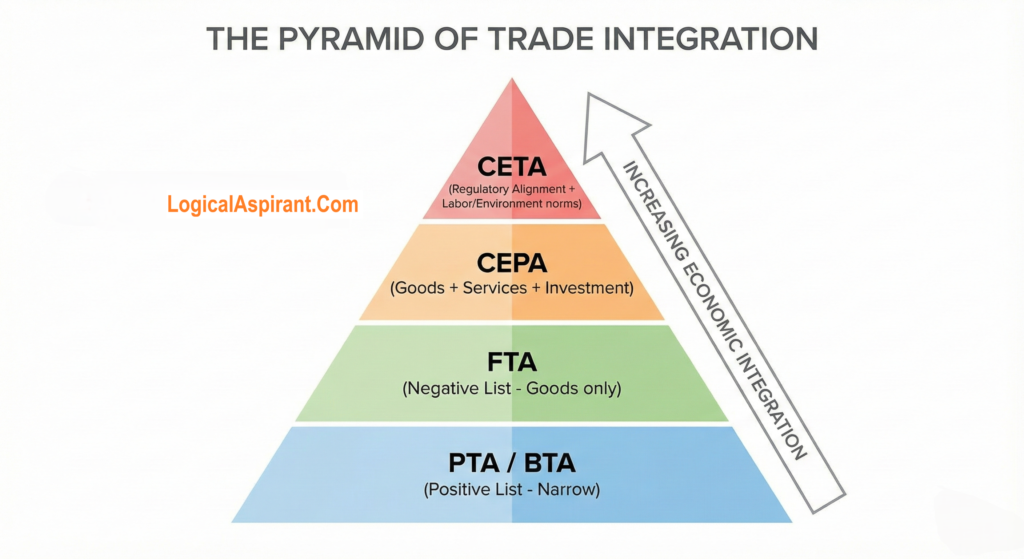

Not all trade deals are same. They follow a hierarchy of economic integration, ranging from simple tariff cuts (BTA/FTA) to deep regulatory harmonisation (CETA).

Types of Trade Agreements Explained: Key Differences Between FTA, PTA, CEPA & CETA

BTA (Bilateral Trade Agreement) / PTA (Preferential Trade Agreement)

BTA is strictly an agreement between two nations (e.g., India and Afghanistan). A BTA can be anything it can be a PTA or a CEPA, as long as it is between two parties.

PTA creates a Positive List. Tariffs are reduced only on the specific goods listed (e.g., 50 items). All other goods remain taxed at standard rates. Often the starting point of negotiations (like the early stages of India-US talks). PTA can be Bilateral (India-Chile) or Multilateral (APTA – Asia Pacific Trade Agreement).

FTA (Free Trade Agreement)

- FTA is “Negative List” Approach – A major upgrade from BTA.

- Tariffs are eliminated on everything, except for a small “Negative List” (sensitive items like dairy or agriculture for India).

- It primarily removes duties on goods but may not cover services or regulations deeply.

- Example: India-Sri Lanka FTA.

CEPA (Comprehensive Economic Partnership Agreement)

- Beyond Goods: This is where “Deep Economic Integration” begins.

- It bundles four pillars:

- Goods (Lower tariffs)

- Services (Visa ease for professionals, mutual recognition of degrees)

- Investment (easier FDI rules)

- IPR & Competition (fair play rules).

- It treats the partner nation almost like a domestic state in economic terms.

- Examples: India-UAE CEPA (2022), India-Japan CEPA (2011).

CETA (Comprehensive Economic and Trade Agreement)

- The deepest form of modern agreement.

- It includes everything in a CEPA plus Regulatory Harmonisation.

- It tackles “Non-Tariff Barriers.” Countries agree to align their labor standards, environmental laws, and safety checks so that a product made in India is automatically accepted in the partner country without re-testing.

- Current Flagship: India-UK CETA (Signed July 2025).

Related Concepts UPSC May test

- Rules of Origin (RoO): A protective clause in all FTAs/CEPAs. It prevents a third country (like China) from dumping cheap goods into India via a partner country (like the UAE). To claim low tariffs, a product must have a minimum “value addition” (usually 35-40%) within the partner country.

- Early Harvest Scheme (EHS): A strategy where countries sign a “mini-FTA” to harvest the low-hanging fruits (easy tariff cuts) while still negotiating the difficult parts of a full CEPA. (e.g., India-Australia ECTA was effectively an Early Harvest deal before the full CECA).

- Investment Protection (BIT vs. CEPA): Investment protection was historically done via separate Bilateral Investment Treaties (BITs). Modern CEPAs now absorb these investment rules, making separate BITs redundant in those cases.

Points to remember for Exam

- PTA = Positive List (Only listed items get benefit). FTA = Negative List (All items get benefit except listed ones).

- CECA vs. CEPA:

- Functionally, they are 95% similar. CECA (Cooperation) is often used with Southeast Asian nations (Malaysia, Singapore) and focuses a bit more on tariff reduction. CEPA (Partnership) is broader, often including regulatory aspects and investment. For Prelims, treat them as “Deep Integration” compared to standard FTAs.

- Trade Deficit Myth:

- Trap: “Signing an FTA guarantees a trade surplus.”

- Reality: Historically, India’s trade deficit often widened after FTAs (e.g., with ASEAN) because imports of raw materials increased. FTAs boost volume, not necessarily surplus.

Trade agreements have evolved from simple “tax cuts” (FTA) to “regulatory mergers” (CETA). As India moves towards the $5 Trillion economy goal, the shift from narrow BTAs to deep CEPAs/CETAs reflects a desire to integrate into global value chains, not just sell products.

Various Trade Agreements India has signed

| Partner (Country/Bloc) | Type | Status | Date Signed | Key Unique Features (Prelims Specific) |

| Oman | CEPA | Signed (Ratification Pending) | Dec 18, 2025 | • Gateway to GCC: India’s 2nd CEPA in the Gulf. • 99% Duty-Free: Immediate zero duty on Indian textiles, electronics, & pharma. • Strategic: Cementing ties near the Strait of Hormuz. |

| United Kingdom(UK) | CETA(Comp. Economic & Trade Agreement) | Signed(Under Ratification) | July 24, 2025 | • DCC (Double Contribution Convention): Exempts Indian professionals from paying UK social security tax (huge savings). • Whisky Tax: Cut from 150% → 75%. • First: Full FTA with a G7 nation. |

| EFTA Bloc(Switzerland, Norway, Iceland, Liechtenstein) | TEPA(Trade & Economic Partnership) | Implemented | Signed: Mar 10, 2024 Enforced: Oct 1, 2025 | • Binding Investment: First-ever legal commitment by a partner to invest $100 Billion in India (15 years).• Revitalized: Replaced the deadlock on IPR issues. |

| Uzbekistan | BIT(Bilateral Investment Treaty) | Implemented | Signed: Sep 27, 2024 Enforced: May 15, 2025 | • Counterclaims: A unique clause allowing the State to sue the Investor for corruption or fraud (rare in BITs). • Model BIT: Aligned with India’s 2016 restrictive model. |

| IPEF Bloc (US, Japan, Australia, +11 others) | Supply Chain Agreement (Pillar II) | Implemented | Signed: Nov 14, 2023 Enforced: Feb 24, 2024 | • Crisis Response Network: An “emergency hotline” for supply chains during pandemics/wars.• Note: India signed Pillars II, III, IV but opted out of Pillar I (Trade). |

| UAE | BIT(Bilateral Investment Treaty) | Implemented | Signed: Feb 13, 2024 Enforced: Aug 31, 2024 | • Continuity: Replaced the expired 2013 treaty. • Enterprise-based: Protects the company in India, not just the assets, limiting arbitration scope. |