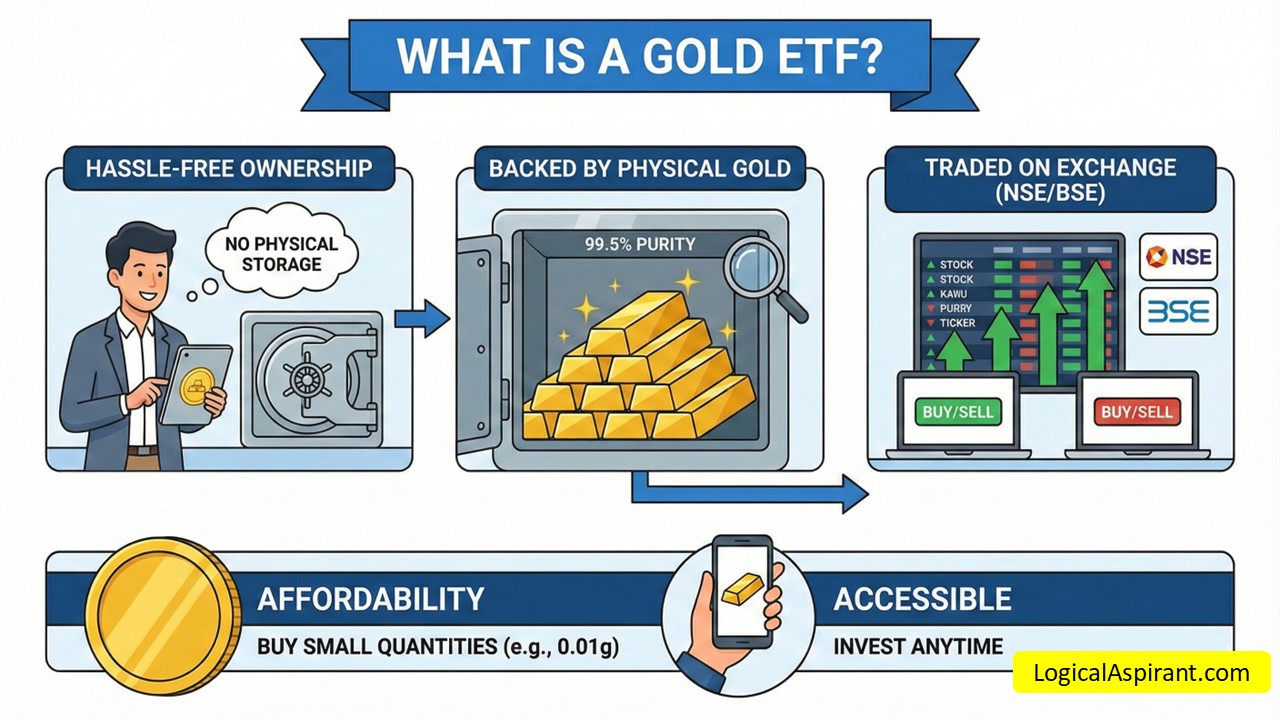

Context: This topic was recently highlighted in The Hindu (27.12.25) following reports that Indian investor interest in Gold Exchange Traded Funds (ETFs) has surged this year.

What is a Gold ETF?

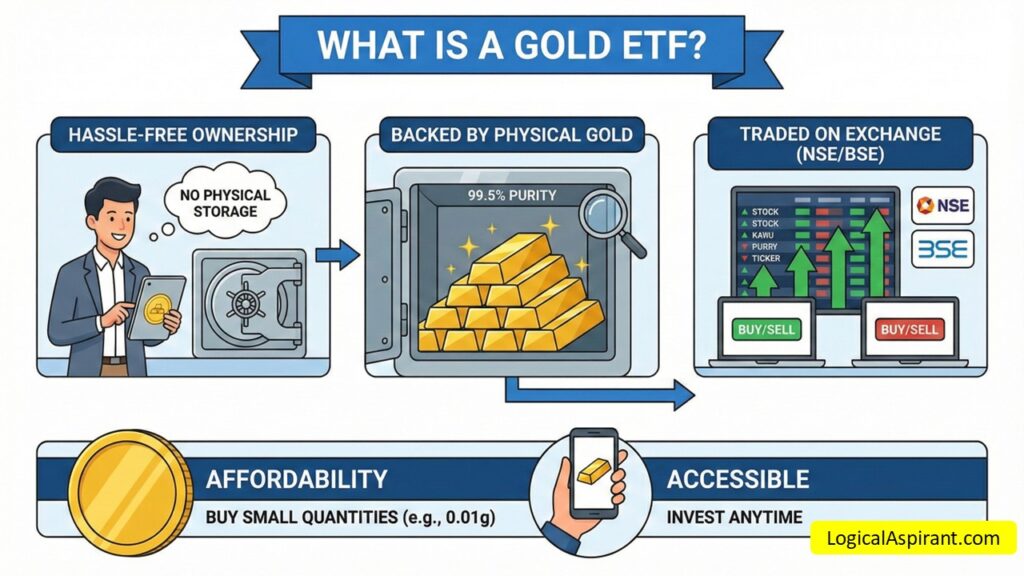

A Gold ETF (Exchange Traded Fund) is a solution for investors who want to own gold without the hassle of buying physical metal.

• Gold ETFs are financial instruments that function like shares. They are backed by physical gold of 99.5% purity, which is held by the fund house (Asset Management Company) offering the ETF.

• As the name suggests, these funds are “Exchange Traded,” meaning you can buy and sell them throughout the day on the stock market (NSE/BSE), just like any other company stock.

• Unlike physical jewelry, Gold ETFs allow you to buy very small quantities of gold (often as low as 0.01 grams), making them highly accessible.

Comparison: Physical Gold vs. Gold ETF

| Feature | Physical Gold (Jewelry/Coins) | Gold ETF (Digital) |

| Purity | Risk of impurity or fake gold. | Guaranteed 99.5%+ purity. |

| Safety | High risk of theft; often requires a bank locker. | Electronic safety (stored securely in your Demat account). |

| Extra Costs | High “Making charges” (10-20% of value is often lost). | Low annual fees (Expense ratio of 0.5-1%) & standard brokerage. |

| Selling | Jeweler may deduct money or pay below market rate. | Sell instantly on the stock market at transparent, real-time rates. |

| Purchase Size | Expensive (usually requires buying at least a coin or ring). | Affordable (can buy as little as 1 unit, equivalent to ~0.01g or 1g). |